India’s tyre industry is on the brink of unprecedented growth, with production volumes projected to expand nearly four times and revenues expected to grow 12-fold to reach ₹1,300 thousand crore by 2047, according to a new report by the Automotive Tyre Manufacturers Association (ATMA) and PwC India, titled “Viksit Bharat 2047: Vision and roadmap for the Indian tyre industry.”

The exponential growth forecast is attributed to strong domestic OEM and replacement tyre demand, accelerated vehicle exports, and a shift in the industry’s revenue mix towards premiumization, sustainability, raw material price shifts, electrification, and servitisation.

Tyre Industry at the Cusp of Transformation

Highlighting the opportunity, Kavan Mukhtyar, Partner and Leader – Automotive, PwC India, said:

“India’s journey towards Viksit Bharat 2047 presents a huge opportunity for the tyre industry, not only to meet the aspirations of its domestic customer base but also to exponentially scale up tyre exports, especially in the commercial vehicle and passenger vehicle segments across key markets like the US and EU. Emerging consumer trends and mobility shifts, a dynamic global business environment, and sustainability imperatives present a unique opportunity for the Indian tyre industry to transform itself and drive sustainable growth through 2047. Innovating at speed for global markets through advanced material engineering, finding sustainable alternatives for natural rubber, and addressing sustainability imperatives throughout the value chain will be key to unlocking growth potential for the industry. Additionally, brand strengthening in export markets and investing in digital technologies across the value chain will be essential to drive productivity and a sustained global competitive advantage.”

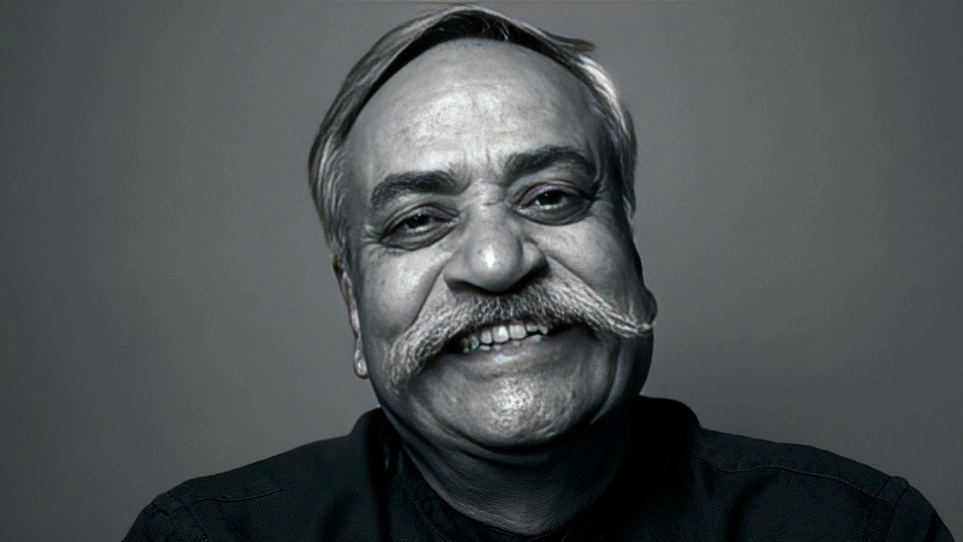

Echoing the industry’s optimism, Arun Mammen, Chairman, ATMA, noted:

“The Indian Tyre Industry stands at the cusp of a transformational journey, driven by rapid economic growth, evolving mobility trends, and an expanding global footprint. The findings of the ATMA-PwC report underscore the industry’s immense growth potential, with revenue projected to grow 12-fold by 2047. This growth will be fueled by a shift towards premiumization, sustainability-led innovation, and a strong focus on technology and exports. As we move towards ‘Viksit Bharat 2047,’ the Tyre Industry is poised to play a pivotal role in enabling India’s automotive ambitions to build a resilient and future-ready sector.”

The CHARGE Framework: Roadmap to 2047

PwC has proposed the CHARGE framework to guide this transformation, focusing on:

-

Customer relevance

-

High-quality standards

-

Adaptability

-

Resilience, resource efficiency & sustainability

-

Growth through innovation

-

Empowering alliances & partnerships

The framework emphasizes customer-centricity, agility, futuristic technologies, operational efficiency, and strategic collaborations to accelerate growth.

Sanjay Dawar, Partner and Leader – One Consulting, PwC India, stressed the need for a holistic approach:

“The Indian tyre industry is at an inflection point, with the potential to create significant economic value and strengthen India’s global competitiveness. Achieving this twelve-fold revenue growth will require a holistic approach — one that brings together innovation, sustainability, digital transformation, and strong partnerships across the ecosystem. At PwC, we are committed to working alongside industry stakeholders to co-create strategies that can accelerate momentum, build resilience, and help realise the Viksit Bharat 2047 vision.”

Key Growth Drivers and Challenges

🔹 Domestic Market Growth:

-

OEM and replacement tyre revenue is projected to grow at ~10% CAGR till FY47.

-

Rising passenger vehicle and two-wheeler sales, coupled with strong CV demand driven by infrastructure and consumption growth, will fuel tyre demand.

-

Increased mobility and freight availability will strengthen replacement tyre sales.

🔹 Export Market Expansion:

-

Tyre exports will see a significant surge by FY47.

-

Growth will be driven by export-centric strategies, Free Trade Agreements (FTAs), market-specific innovations, and stronger brand positioning, especially in PV and CV tyre segments.

-

Challenges include raw material supply, regulatory dynamics, and non-tariff barriers.

🔹 Servitisation & Tyre Management Services:

-

Professional tyre management services among fleet operators will become mainstream by FY47.

-

Growing awareness of tyre health, TPMS-ready fleets, and optimal fleet management solutions will fuel demand.

-

Companies must address data security, cost competitiveness, and regulatory issues to unlock full potential.

Outlook: Tyre Industry as a Pillar of Viksit Bharat 2047

The ATMA–PwC report highlights that India’s tyre industry is positioned as a key enabler of the country’s automotive ambitions, contributing to exports, technological leadership, and sustainable mobility.

By 2047, the industry will not only meet domestic aspirations but also strengthen its footprint as a global leader in tyre innovation, sustainability, and exports.