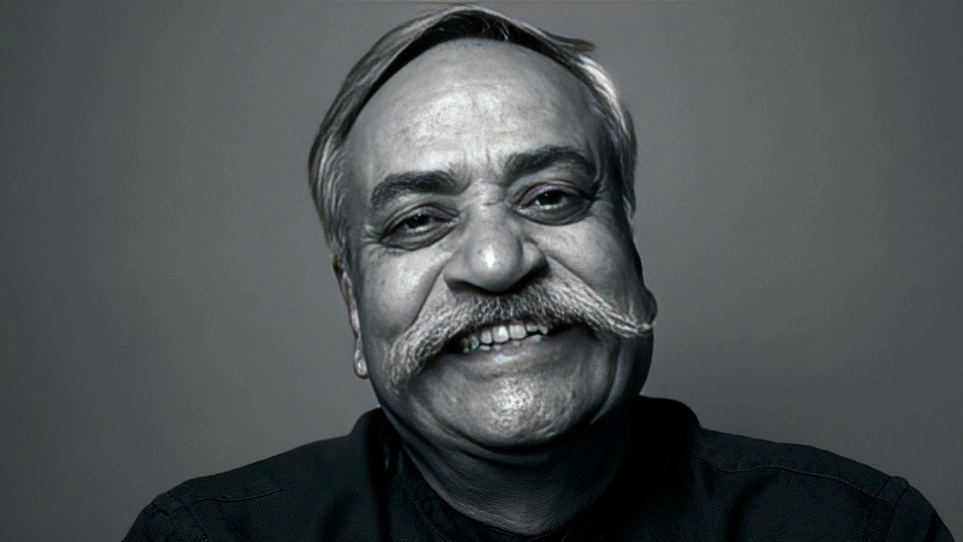

In our insightful interview, Dr. Pramod delves into his inspiration for focusing on ESG and sustainability, the integration of ESG principles into business strategy, and the impact these initiatives have on performance. He shares successful ESG initiatives, key metrics for measuring success, and the challenges companies face in implementing ESG strategies. Dr. Pramod also discusses emerging trends in ESG and sustainability that will shape future corporate practices and anticipates how upcoming regulatory changes will affect companies’ ESG strategies and overall business operations.

Let’s deep dive into this insightful discussion below.

What inspired you to focus on ESG and sustainability in your professional career?

In my professional journey, I have always been passionate about the intersection of business, social impact, and environmental responsibility. I firmly believe that businesses have a crucial role to play in driving positive change for society and the planet. This belief is rooted in the ancient Indian philosophy of “Loka Samastah Sukhino Bhavantu” (लोका समस्ताह सुखिनो भवन्तु), which means “May all beings in the world be happy and prosperous.” This shloka inspires me to focus on ESG (Environmental, Social, and Governance) and sustainability as key pillars in my professional career, as I believe that businesses have a responsibility to create value for all stakeholders – customers, employees, investors, and the communities we serve – while also promoting the well-being of the planet.

The concept of “Loka Samastah Sukhino Bhavantu” resonates with me because it emphasizes the interconnectedness of all living beings and the importance of working towards the greater good. In the context of ESG and sustainability, this means recognizing that business decisions have far-reaching consequences for the environment, society, and the economy, and that we must strive to create positive outcomes for all stakeholders.

By integrating ESG principles into business strategy, I believe that we can create long-term value for all stakeholders while also contributing to a more sustainable and equitable future. This inspires me to continue working towards a future where businesses are a force for good, and where we can all thrive together.

How do companies integrate ESG principles into their overall business strategy, and what impact has this had on their performance?

Companies integrate ESG principles into their overall business strategy through a structured approach that involves setting clear goals, targets, and metrics. ESG considerations are embedded into decision-making processes, and a robust governance structure is established to oversee ESG performance and ensure accountability.

The integration of ESG principles has had a positive impact on companies’ performance, including improved brand reputation, enhanced stakeholder trust, and increased operational efficiency. ESG considerations also help companies identify and manage risks, reduce costs, and capitalize on new business opportunities.

Can you share an example of a successful ESG initiative and the key factors that contributed to its success?

One successful ESG initiative is a “Green Logistics” program, which aims to reduce the environmental impact of logistics operations. The program involves the use of alternative fuels, optimization of transportation routes, and implementation of sustainable packaging solutions.

The key factors that contributed to the success of this initiative include:

- Strong leadership commitment and support

- Collaboration across functions and departments

- Clear goals and metrics

- Employee engagement and training

- Continuous monitoring and evaluation

As a result of this initiative, significant reductions in greenhouse gas emissions, fuel consumption, and packaging waste were achieved. This initiative not only contributed to ESG performance but also generated cost savings and improved operational efficiency.

What metrics or KPIs do companies use to measure the success and impact of their ESG initiatives?

Companies use a range of metrics and KPIs to measure the success and impact of their ESG initiatives. These include:

- Carbon footprint reduction

- Renewable energy usage

- Water and waste reduction

- Supply chain sustainability performance

- Diversity, equity, and inclusion metrics

- Employee engagement and training metrics

- Stakeholder satisfaction and reputation metrics

Companies also use industry-recognized frameworks and standards, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), to guide their ESG reporting and performance measurement. This enables them to track their progress, identify areas for improvement, and make data-driven decisions to drive their ESG strategy forward.

What are the biggest challenges companies face when implementing ESG strategies, and how do they overcome them?

One of the biggest challenges companies face when implementing ESG strategies is the need to balance short-term business priorities with long-term sustainability goals. Another challenge is ensuring that ESG considerations are integrated into decision-making processes and are not seen as an add-on or a separate initiative.

To overcome these challenges, companies establish a robust governance structure that ensures ESG considerations are embedded into their business strategy and operations. They also develop comprehensive ESG training programs for employees to raise awareness and build capacity. Additionally, companies engage with stakeholders, including NGOs, industry associations, and investors, to stay informed about emerging ESG trends and best practices.

What emerging trends in ESG and sustainability do you believe will be most influential in shaping the future of corporate practices?

I believe that emerging trends such as climate action, circular economy, and digital sustainability will be most influential in shaping the future of corporate practices. The increasing focus on climate action will drive companies to adopt more ambitious emission reduction targets and invest in low-carbon technologies. The circular economy trend will encourage companies to adopt closed-loop production systems and reduce waste.

Digital sustainability will also play a critical role in shaping the future of corporate practices, as companies leverage technology to drive ESG performance, improve transparency, and engage stakeholders. Furthermore, the growing importance of social justice and human rights will require companies to prioritize diversity, equity, and inclusion and ensure that their operations respect human rights.

How do you anticipate upcoming regulatory changes will affect companies’ ESG strategies and overall business operations?

I anticipate that upcoming regulatory changes will have a significant impact on companies’ ESG strategies and overall business operations. For instance, the increasing focus on climate action will lead to more stringent regulations on carbon emissions, which will require companies to accelerate their transition to low-carbon operations.

The European Union’s Sustainable Finance Disclosure Regulation (SFDR) will also require companies to enhance their ESG disclosure and reporting. Additionally, emerging regulations on circular economy and waste reduction will drive companies to adopt more sustainable product design and waste management practices.

To prepare for these changes, companies are engaging with policymakers, industry associations, and stakeholders to stay informed about emerging regulatory trends and ensure that their ESG strategies are aligned with these changes. They’re also investing in innovation and R&D to develop new sustainable technologies and solutions that will enable them to stay ahead of the regulatory curve.

Note: We are also on WhatsApp, LinkedIn, and YouTube, to get the latest news updates, Join our Channels. WhatsApp– Click here, and for LinkedIn– Click Here.